Description

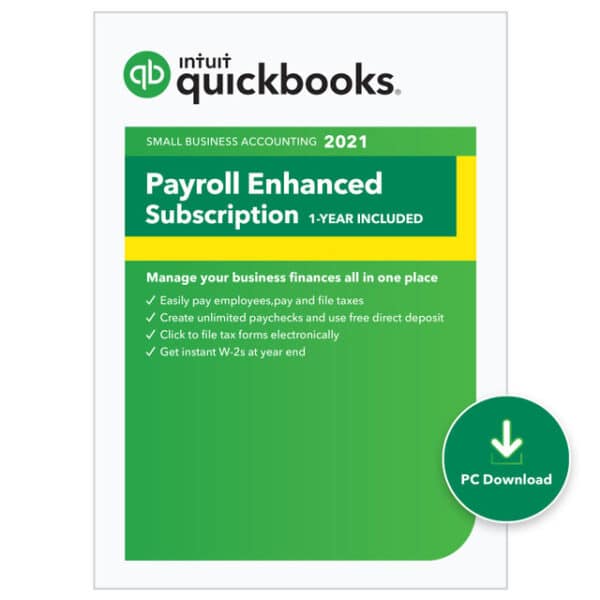

QuickBooks Enhanced Payroll is a powerful payroll processing add-on designed for small to mid-sized businesses using QuickBooks Desktop. It offers comprehensive features to manage employee payroll efficiently and stay compliant with federal and state tax regulations.

🔧 Key Features:

-

Unlimited Payroll Runs

Run payroll as often as needed—weekly, bi-weekly, monthly, or custom schedules—without extra fees. -

Automatic Tax Calculations

Calculates federal and state payroll taxes automatically, including Social Security, Medicare, and unemployment. -

Pay Employees Easily

Create paychecks or use direct deposit to pay W-2 employees and 1099 contractors. -

Payroll Tax Forms & Filings

Fill out and file federal and state tax forms such as 941, 940, W-2, and W-3 directly from QuickBooks. You can also print year-end forms for employees. -

E-file and E-pay

With Enhanced Payroll, you can electronically file your taxes and pay them directly from your account. -

Payroll Reports

Generate detailed payroll summaries, employee earnings, tax liability, and more for recordkeeping and insights.

💡 Why Choose Enhanced Payroll?

QuickBooks Enhanced Payroll is ideal for business owners who prefer to manage payroll in-house while maintaining control over tax filings and payments. It offers an affordable, do-it-yourself solution with support from QuickBooks and automatic tax updates.

Reviews

There are no reviews yet.